Understanding The Basics of Mexican Insurance for Canadians

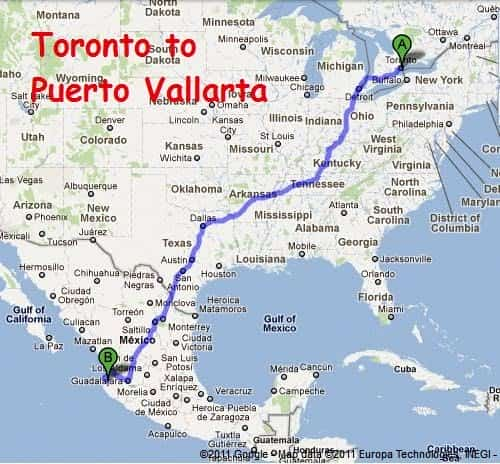

Many people spend extended time in Mexico to determine whether they like the lifestyle and area before settling for retirement or long-term interests. While border communities may allow you to move back and forth across the border for travel needs, deciding to live farther beyond the border requires a stronger sense of commitment to your choice. If you plan an initial long-term stay to make such decisions, be sure that you have reliable Mexican insurance for Canadians as you prepare to go. You will want to include trailers or other towed items on your Mexican auto insurance for Canadians as well. Take time to research car insurance online to cover all essential aspects of your driving in Mexico.

Mexican Insurance for Canadians Liability Limits

Staying close to the border makes it much simpler to choose your liability amounts when you buy Mexican insurance for Canadians. Each state’s death benefits can vary based on average wages in the area. And this will affect the amount of coverage needed on your Mexican auto insurance for Canadians. In Baja Norte, for example, you will need to select relatively high liability limits. On the other hand, your limits might be pretty low in Sonora due to a low death benefit. When in doubt, it is wise to opt for a higher limit. This is especially true if you might travel outside of the state you will live in during your long-term stay.

Vandalism and Theft

You may choose to reside in a small community or in a rural area where crime seems to be minimal. However, you could still be exposed to the possibility of vandalism or theft with your vehicle en route to your destination. The less familiar you are with the country, the more appropriate to consider expanded car insurance. Full-coverage auto insurance addresses the total theft of your vehicle. However, an extended policy allows for benefits to be provided in partial theft or vandalism.

Traveler Resources

Your car insurance provides access to bilingual information and service in a roadside emergency. It also includes legal help in case of an accident. Your coverage may help with medical evacuation and trip interruption as well. However, you will have to track down medical insurance options for Mexico independent of your car insurance.

Subscribe by Email

Recent Posts

- Mexico’s Hidden Gems: Beyond the Tourist Traps

- Top 10 Cities in Mexico for Road Trippers: Navigating with Mexico Car Insurance

- 2024 Mexico Road Trip Planner: Essential Travel Tips and Vehicle Insurance in Mexico Insights

- Discover Guanajuato: A Gem in Mexico’s Crown, Safely with Mexican Driving Policies

- Unraveling the Mystery: The Cost of Quality Travelers Auto Insurance

- Navigating Vehicle Insurance for Mexico – A Comprehensive Guide

- Introduction to Mexican Car Insurance Services

- Introduction to Mexican Auto Insurance in San Diego

- Understanding Car Insurance in Mexico: Coverage, Costs, and Considerations

- Mexican Insurance for Brownsville, Texas Travelers

- Essential Guide to Mexican Insurance for San Ysidro Residents

- Seamless and Direct: The Store’s Mexican Insurance Experience – Combining Speedy Service with Personalized, Middleman-Free Support

- Understanding US and Canadian Car Insurance Inside Mexico: Key Tips for Travelers

- Comprehensive Review of Mexican Auto Insurance for Rocky Point: Focusing on the Mexican Insurance Store

- Navigating Mexican Car Insurance Policies: A Thorough Guide for Travelers

- Mastering Mexican Car Liability Insurance: Key Insights for a Seamless Journey

- In-Depth Guide to Selecting Mexico Auto Insurance Online for Your Trip

- Navigating the Ins and Outs of Mexican Insurance in San Ysidro and San Diego: A Comprehensive Guide

- Navigating Mexico Insurance Services: Understanding Mexico Auto Insurance Costs and Coverage

- Comprehensive Guide to Car Insurance for Your Mexico Trip – A Must-Have for Tourists

- The Significance of Buying Quality Mexican Auto Insurance

1 Comment. Leave new

Unlike Americans, many Canadians visiting Mexico for the first time seem to get lost in terms of the Mexican way of doing things. But, the most important thing that you must learn in order to stay safe on Mexican roads is to have online Mexican auto insurance.