Filing a Mexico Insurance Claim When Things Go Wrong

“Everybody thinks they have great insurance until they file a Mexico insurance claim.†–Anonymous

Story by Jim Foreman

You are driving along in town on your way to the market. While stopped at a red light, a car slams into your rear bumper because the driver was texting.

What you do next has a significant impact on how your day goes.

If your first reaction is to call 066 or 911 to summon the authorities, you are making a grave mistake. Your first call should be to your insurance company’s new claim phone number on your Mexico insurance policy to immediately send an adjuster to your location. Before you embark on your journey, you should add your Mexico insurance policy claim reporting phone number into your phone’s address book. Also, cut out and keep the insurance ID card in your wallet. If you don’t have insurance, then you should consider getting an insurance quote before traveling.

Mexico has a different legal system than the USA or Canada. Unlike back home, assigning fault happens on-site by a responding officer. Unless you have video evidence to show the officer that shows up, expect to be found at fault.

Fortunately, unless you bought your Mexico insurance policy through your home (US or Canadian) provider, all claim and incident details will remain in Mexico and will not result in a rate increase back home. If you did buy your coverage from your home auto insurance provider, you would likely see a rate increase. The accident and claim get reported back to them.

Why will you be considered ‘At-Fault’? You ask. There are a couple of factors at play that you need to be aware of. The first is that you are automatically considered rich, no matter your financial situation; being a Gringo, you are automatically considered rich. Next, unless you or a passenger has a good command of Spanish, it may be the other person’s story of how you backed into her that is used to determine the fault.

Discover the 15 Biggest Rookie Mistakes Travelers Make in Mexico

Now, If you wisely called your insurance provider, an adjuster will arrive on site. About 95% of any hassle disappears immediately. They will listen to what you have to say and work with the authorities to get your side of the story, front, and center. Additionally, they will confirm to the authorities that you have an active policy and do not need to be placed in jail until you make full restitution.

THROWN IN JAIL??? WHAT? Yes, in Mexico, if you are involved in a collision and deemed at fault, you will be forced to make immediate restitution based on an amount estimated by the authorities. If you do not have up to $300,000USD in cash with you, you will be jailed until you or your family pays the restitution to the assigned victim. Think of this when some idiot tries to say you don’t need a Mexico insurance policy.

If you disagree with the officer’s verdict, you will be placed in jail pending a hearing before a judge within about 24 hours. You will be able to plead your case and see if the verdict changes. Usually not.

With the adjuster on-site, you will be given automatic bail not to have to avoid going to jail, and you will have an advocate on your side trying to look out for your and ultimately the insurance company’s interests.

Starting The Right Way

First things first, you have to buy a quality policy that will actually cover you in the event of a collision or damage to your vehicle. Not all insurance providers are the same. If you are shopping for the cheapest policy, you will inevitably get exactly what you pay for. Coverage will be minimal, if any at all, and you will be screwed six ways until Sunday.

When purchasing your coverage, a reputable broker will never offer or sell these near-worthless policies. Stick with a policy from Chubb, Mapfre, or HDI. Between them, it’s this writer’s opinion that Chubb is best and offers more useful benefits.

When purchasing your coverage, a reputable broker will never offer or sell these near-worthless policies. Stick with a policy from Chubb, Mapfre, or HDI. Between them, it’s this writer’s opinion that Chubb is best and offers more useful benefits.

Buying a Mexico Insurance Policy

When entering the details for your quote and ultimately your policy, be entirely truthful. Indicate any lienholder, and make sure to indicate if you have a full-coverage policy at home accurately. Yes, it matters.

Surprisingly, people always ask if they should buy liability only or get full coverage. This is quickly answered by the policy one keeps at home. If your home policy is full coverage, then get full coverage in Mexico. This is especially true if you have a lienholder. If you have an older vehicle and are okay walking away from it if it’s totaled, then purchase a liability only.

Next, use KBB or NADA Guides to determine the value of your car, truck, RV, or motorcycle. Whatever the highest retail amount is listed, that’s what you should enter as the value for your vehicle. This is the same scale that the insurer will use to determine the value of your vehicle if it needs to be totaled.

Look carefully at all the policy offerings. Unless you are staying in the country for an extended period, such as winter, or have a second home there, you will probably want to repair your vehicle back in the United States. Compare the towing coverage, and most importantly, the labor rate limits. Each program is different. This can mean a considerable difference in possible out-of-pocket expenses.

Once you’ve determined the level of Mexico insurance policy coverage you are comfortable with, purchase the policy. When you do, print out two copies and save the .pdf file on your phone (iBooks or Documents Folder), and to open it, you can use software like Soda PDF which is great for this. You should keep one hard copy in your glove compartment, and you should hold the other with you, probably folded in your luggage or with other important papers.

As mentioned earlier, enter the phone number to file a claim in your phone address book along with the policy number in the ‘notes’ section.

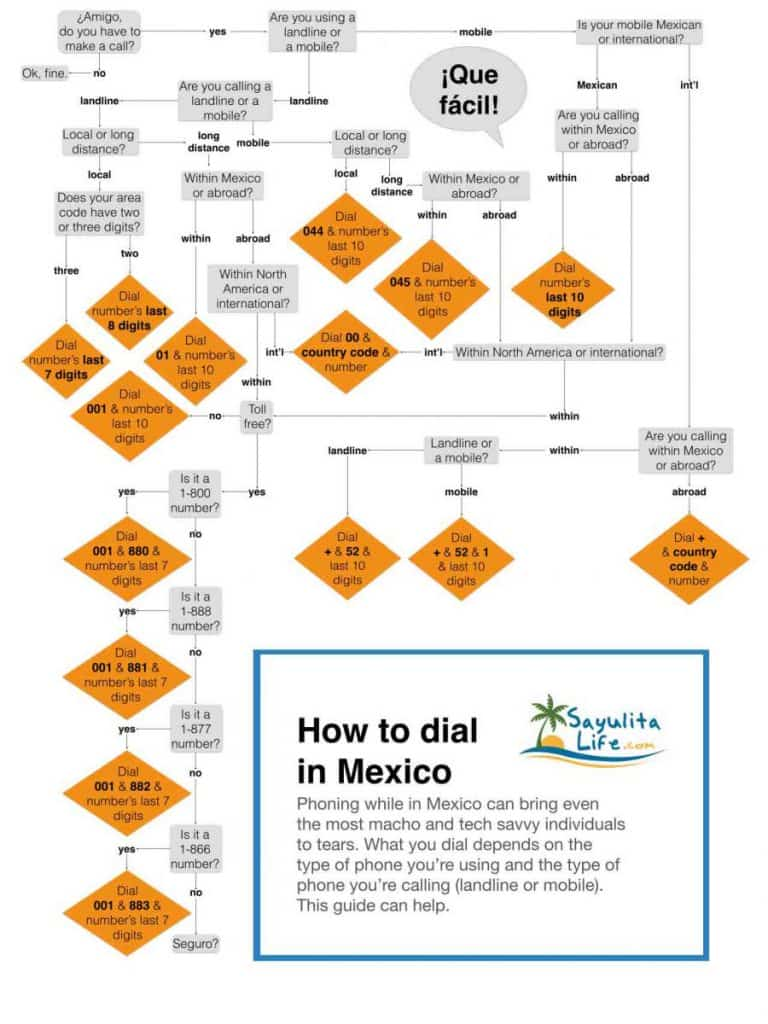

Dialing a number is slightly different in Mexico, so make sure you are familiar with this process. Try to call the number to report a claim, when you are in Mexico. It’s best to be calm and relaxed rather than when you’re in the middle of a crash scene and nervous.

Few people think of these things until they are in the middle of a difficult situation. Hopefully, you will never need to use the insurance, but if you do, your use of it will be a huge factor in the ease or frustration of getting help.

After the Incident

After the insurance adjuster confirms to the authorities you have proper insurance, and the scene is cleared, you have the option to take your vehicle to a nearby repair facility, or to take your vehicle back to the United States. Your decision may be based on how far south you are.

USD 1000 tow coverage will pay to have your vehicle towed to the border from as far south as Mexico City or Guadalajara. It won’t be immediate, but it will eventually get there. There are many highly reputable body shops South of the Border. If you are near a big or capital city, consider using your policy to have your vehicle repaired there. If you are driving a unique vehicle, parts will take much longer to get. It may be best to transport it back to the states. This is something you can work out calmly with your insurance company.

If you elect to have the vehicle worked on in the USA, Chubb can handle the claim from Mexico, or you can opt for a Third Party Administrator (TPA) in the USA to finalize the claim and payouts. If you use Mapfre, your claim will be transitioned to the US-based office for handling. Be patient and work with them, much like you would when dealing with a US claim.

In most cases, the money for the repair will be quickly wired or sent out via check quite quickly. Usually, this happens within two to three weeks.

Additional Hints

If you have full coverage and have damage caused by vandalism or without another party, such as sideswiping a wall or backing into a stationary pole, wait until you are in a bigger city to file a claim and have an adjuster come out.

For minor damage, it will go a lot faster and be much more pleasant if you can wait. Call from a bigger city to have the adjuster come out, even if it’s a couple of days later.

In rural areas, it may take 4-6 hours for the adjuster to show up for your claim. Collisions in bigger towns with multiple parties involved take priority.

When calling to file a claim, you may have to call a phone number with an automated menu in Spanish. Mapfre policies, in particular, do this. You may need to ask a native Spanish speaker for help or practice understanding which number to press to get to auto claims. If you understand the numbers 1-10 in Spanish, you should be mostly there. When someone does answer, kindly ask, “Habla usted Inglés?†Usually, they will have someone who can work with you and understand English. Spellings will be much more difficult. Ask if you can email or use WhatsApp to send the names and spellings. Nearly all Mexicans use WhatsApp for communication, as doing so doesn’t go against data usage with most Mexican mobile plans.

As mentioned earlier, the key to having a positive experience in a difficult situation is to have quality coverage from a reputable source. All of the providers offered up by Mexican Insurance Store are top rated and high quality (A to A++ Rated).

To see your options and compare coverage, start by clicking the orange “Get A Quote†button on the upper right of this page.

About the Author

Jim Foreman has traveled well over 75,000 miles in Mexico. Often, Jim goes by motorcycle but also travels extensively on four wheels.

Jim also runs a motorcycle travel company taking riders South of the Border.

Jim has filed personal claims with both Chubb and Mapfre for minor damage to his vehicles. The insurers handled both quickly and professionally. In most cases, with far less hassle than when filing a US-based claim.

Filing A Claim ©2018 Mexican Insurance Store.

Subscribe by Email

Recent Posts

- Bring the Right Documents with You to Mexico!

- Retire in Mexico and Live Like Royalty

- Mexico’s Hidden Gems: Beyond the Tourist Traps

- Top 10 Cities in Mexico for Road Trippers: Navigating with Mexico Car Insurance

- 2024 Mexico Road Trip Planner: Essential Travel Tips and Vehicle Insurance in Mexico Insights

- Discover Guanajuato: A Gem in Mexico’s Crown, Safely with Mexican Driving Policies

- Unraveling the Mystery: The Cost of Quality Travelers Auto Insurance

- Navigating Vehicle Insurance for Mexico – A Comprehensive Guide

- Introduction to Mexican Car Insurance Services

- Introduction to Mexican Auto Insurance in San Diego

- Understanding Car Insurance in Mexico: Coverage, Costs, and Considerations

- Mexican Insurance for Brownsville, Texas Travelers

- Essential Guide to Mexican Insurance for San Ysidro Residents

- Seamless and Direct: The Store’s Mexican Insurance Experience – Combining Speedy Service with Personalized, Middleman-Free Support

- Understanding US and Canadian Car Insurance Inside Mexico: Key Tips for Travelers

- Comprehensive Review of Mexican Auto Insurance for Rocky Point: Focusing on the Mexican Insurance Store

- Navigating Mexican Car Insurance Policies: A Thorough Guide for Travelers

- Mastering Mexican Car Liability Insurance: Key Insights for a Seamless Journey

- In-Depth Guide to Selecting Mexico Auto Insurance Online for Your Trip

- Navigating the Ins and Outs of Mexican Insurance in San Ysidro and San Diego: A Comprehensive Guide

- Navigating Mexico Insurance Services: Understanding Mexico Auto Insurance Costs and Coverage

18 Comments. Leave new

Being experienced in driving is a big advantage to drive more safely. Aside from this, Mexican auto insurance should be added to increase your protection on the road.

It’s worth getting a long-term Mexico insurance policy if you’re required to travel back and forth several times a year for medical checkups.

Don’t just buy Mexican auto insurance and take off. Significant parts of the car need immediate checkup before leaving like battery, oil, gas, air, lights water.

What should be packed? Well, the climate in Mexico, the places you go, the things you will do, and the length of your vacation—all these determine the things to pack.

We love to fly to reach Mexico but driving is definitely more exciting and pleasurable for a trip.

Fruits are cool edible foods, particularly fruit juices and watery fruits like pineapple and watermelon.

When making bigger transactions in Mexico, it’s more helpful to use your credit cards. Fees tend to be lower than paying cash on big transactions.

I don’t have any idea about what items to buy as souvenirs from Mexico. Is it okay to get some inexpensive shirts and shorts for my friends?

With the existing pandemic, it’s overwhelming and difficult. But there should be avoidance of kissing, touching, and hugging with loved ones.

If you feel doubtful about the credibility of a particular Mexican car insurance website, try to contact their customer service and seek help. Sensible sites do encourage calling their customer service agents to deal with some issues.

All types of resorts, vacation homes and shopping centers flourish in Mexico offering travelers endless options to make the most of their Mexico vacation.

Make a limit to the number of hours you should drive when traveling to Mexico, then stick to it. It’s also soothing to have a playlist of your favorite music before leaving. Don’t forget a Mexican insurance policy for your car.

It’s a wise decision to buy Mexican car insurance from a credible company only. In this day and age, where lots of websites, scrutinizing the reliability of the best provider is mandatory.

If you’re a frequent visitor of Mexico, an annual or a six-month policy is best for coverage benefits and you’ll have peace of mind most of the time.

I’m a worldwide national who have been fortunate enough to go to different parts of the world. I get acquainted with various nationals from diverse cultures. I consider Mexico one of the best places I’ve seen.

Summertime is just around the corner. It’s getting hotter to stay in northern Mexico. The location can experience extreme temperature and this is normal.

If you plan on driving in Mexico, the government requires that you have Mexican car insurance. If you are caught driving without valid insurance, you will be arrested and jailed if there is an accident.

What is needed to bring in Rocky Point? Well, in addition to Mexican auto insurance, you also need a passport card. These documents are a must when entering the border of Mexico.